XRP Price Prediction: Will Institutional Adoption Overcome Regulatory Hurdles?

#XRP

- Technical Outlook: Oversold Bollinger Bands and positive MACD divergence hint at a potential rebound.

- Regulatory Catalyst: SEC lawsuit resolution could trigger a 100%+ rally if favorable.

- Institutional Demand: Participation from BlackRock/Citi may offset retail selloffs.

XRP Price Prediction

XRP Technical Analysis: Key Indicators to Watch

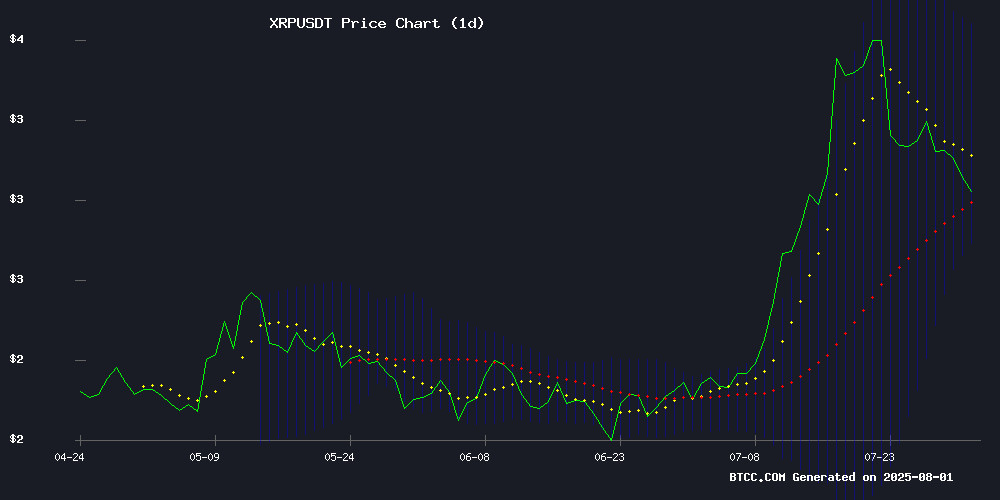

According to BTCC financial analyst Mia, XRP is currently trading at 2.9531 USDT, below its 20-day moving average (MA) of 3.1912, indicating potential short-term bearish pressure. The MACD histogram shows a positive value of 0.2315, suggesting some bullish momentum, but the signal line remains negative at -0.3229. Bollinger Bands indicate that XRP is NEAR the lower band (2.7664), which could signal an oversold condition and a possible rebound if buying interest returns.

XRP Market Sentiment: Mixed Signals Amid Regulatory Developments

BTCC financial analyst Mia notes that XRP's price action is influenced by conflicting news. Positive developments like BlackRock and Citi joining Ripple Swell 2025 could fuel a rally, while the SEC's closed-door meeting and high-volume selloffs create uncertainty. The market sentiment appears cautiously optimistic, with institutional interest balancing regulatory risks.

Factors Influencing XRP’s Price

XRP Surges: Crucial Movements Shape The Crypto Landscape

XRP, a significant asset in the cryptocurrency market, has exhibited notable volatility over the past 24 hours. The price peaked at $3.17 on July 31st before dropping to $2.94 by August 1st, marking an 8% decline. A rapid 2.7% drop coincided with a surge in trading volume, which quadrupled the average to $259.21 million.

Institutional mobility reveals contrasting signals. On-chain data shows large investors and institutional holders sold an average of $28 million worth of XRP daily over the past 90 days, indicating a distribution trend. However, during corrections, over 310 million XRP—valued at approximately $1 billion—was accumulated. The sharp decline in XRP balances on exchanges suggests potential new capital inflows, with some institutional investors possibly viewing price dips as entry opportunities.

Market data reflects recovery efforts, with XRP closing at $2.98. Technical indicators remain under scrutiny as traders assess whether the recent volatility signals a broader trend or short-term fluctuation.

BlackRock, Nasdaq, Citi Join Ripple Swell 2025 – XRP Price Set for 100% Rally?

Ripple's flagship event, Swell 2025, is set to take place in New York City on November 4–5, marking its first appearance in the financial hub. The conference, backed by heavyweights like BlackRock, Nasdaq, and Citibank, has historically been a catalyst for significant XRP price movements, with past announcements driving surges of up to 50%.

This year's event arrives at a critical juncture for Ripple, following its settlement with the U.S. SEC, a $1.25 billion acquisition, and an application for a U.S. banking license. The presence of traditional finance giants signals growing institutional alignment with blockchain innovation.

Swell's invite-only format gathers regulators, banks, and industry leaders for high-impact announcements. Previous editions featured luminaries like Ben Bernanke and product launches such as xRapid and RLUSD stablecoin. The 2025 iteration may eclipse prior events given Ripple's recent regulatory clarity and expansion into enterprise solutions.

Ripple Lawsuit: Speculation Mounts as SEC Holds Closed-Door Meeting

The prolonged legal confrontation between Ripple and the U.S. Securities and Exchange Commission may be nearing a pivotal moment. Market observers are speculating about a potential dismissal after reports surfaced of an SEC closed-door meeting, though experts caution against premature conclusions.

Former SEC attorney Marc Fagel tempered expectations, noting no substantive evidence suggests an imminent case dismissal. The Second Circuit Court of Appeals maintains the case in abeyance, with the SEC required to submit a status update by August 2025. Any resolution would require formal commissioner approval before Ripple's escrowed penalty could be processed.

XRP Drops 8% Amid High-Volume Selloff, Whales Send Mixed Signals

XRP tumbled 8% in 24 hours, retreating from a session high of $3.17 to $2.94 as resistance triggered aggressive profit-taking. The midnight UTC selloff on August 1 saw 259 million tokens change hands—four times the daily average—before institutional bids stabilized prices near $2.98.

Whale wallets show contradictory behavior: Chain data reveals persistent distribution by early holders over 90 days, yet exchange outflows during the dip suggest accumulation. BlackRock's digital asset director Maxwell Stein reinforced institutional interest by confirming participation at an undisclosed industry event.

Ripple's XRP Adoption Struggles Persist Despite Banking Partnerships

Ripple's XRP ledger, launched in 2012 with ambitions to revolutionize cross-border payments, continues to face adoption hurdles. Despite securing over 300 bank partnerships, on-chain transaction volumes remain disappointingly low. David Schwartz, Ripple's co-founder, recently addressed growing concerns among XRP holders regarding the token's limited real-world usage.

Institutional reluctance stems from multiple factors: price volatility deters risk-averse banks, private blockchain solutions offer more control, and stablecoins increasingly dominate settlement use cases. The XRP ledger processes significantly fewer transactions than competing networks, raising questions about its long-term role in global finance.

Market dynamics have shifted since Ripple's inception. Regulatory uncertainty persists, while alternative solutions like central bank digital currencies and private institutional networks gain traction. The disconnect between Ripple's partnership announcements and actual XRP utilization suggests many banks prefer off-chain implementations of the technology.

Ripple Awaits SEC Move as Case Nears End After $125M Penalty Payment

The SEC's closed-door meeting today at 2:00 PM ET has sparked intense speculation within the XRP community. The agenda includes "resolution of litigation claims," raising hopes for a potential conclusion to the long-standing legal battle between Ripple and the SEC. Ripple has already fulfilled its obligations by paying a $125 million penalty and dropping its cross-appeal in June 2025.

Judge Analisa Torres' July 2023 ruling created a split decision—institutional sales of XRP violated securities laws, while public sales did not. This partial victory for Ripple now hangs in the balance as the SEC delays withdrawing its appeal. The crypto market watches closely, as the outcome could set a precedent for how regulators treat digital assets moving forward.

Procedural resolution now rests entirely with the SEC. Their inaction has become a growing source of frustration for XRP holders and the broader crypto community. Today's meeting could mark a turning point—either clearing the path for Ripple's future operations or prolonging the regulatory uncertainty that has shadowed XRP since December 2020.

XRP Community Defends Asset's Performance Amid Short-Term Trader Frustration

Crypto researcher Anderson has challenged the narrative of XRP's underperformance, noting the asset has surged 6X from $0.50 since November. The rebuttal comes as some traders express frustration over XRP's failure to sustain momentum after briefly touching $3.66 earlier this month.

Wednesday's dip to $3 triggered fresh short positions, though bulls defended this psychological support level. "The market lacks patience," Anderson observed, pointing to XRP's position among crypto's top performers this year. Community members attribute complaints to unrealistic expectations of overnight gains rather than fundamental weaknesses.

XRP Price Prediction: Double Bottom Forms Amid Bearish Pressure

XRP shows tentative signs of a bullish double bottom pattern while clinging to the critical $3 support level. The token recorded its strongest monthly performance in July, rallying 41% despite recent liquidations exceeding $17.5 million. Long positions bore the brunt as prices faced rejection near $3.2.

Market sentiment remains cautiously optimistic with positive funding rates and monthly futures trading at a 6-8% premium. However, weakening on-chain metrics threaten buyer momentum, creating potential downside risk if support fails.

Find Mining Emerges as Leader Amid Crypto Policy Shifts and Institutional Adoption

The White House's landmark crypto policy report has set the stage for unified regulations on stablecoins, digital asset securitization, and market oversight. This regulatory clarity coincides with JPMorgan's partnership with Coinbase, signaling a pivotal convergence of traditional finance and digital assets.

Find Mining capitalizes on this momentum, positioning itself as a next-generation platform for compliant and efficient crypto mining. The service offers automated cloud mining with a $15 welcome bonus, lowering barriers to passive income generation through digital assets.

XRP emerges as a focal point in Find Mining's ecosystem, with a minimum deposit threshold of 32 XRP required to increase mining power. The platform's wallet integration facilitates seamless transfers from exchanges or personal wallets.

XRP Holders Turn to Cloud Mining for Stable Returns Amid Market Volatility

Ripple's XRP investors are increasingly adopting cloud mining as a hedge against the cryptocurrency's price swings. PaladinMining has emerged as a preferred platform, offering $3,720 daily yields through its optimized infrastructure. The service eliminates traditional mining barriers—equipment costs, technical expertise, and energy overhead—by providing automated contract-based returns.

Cloud mining's appeal lies in its insulation from market turbulence. PaladinMining guarantees fixed daily payouts, contrasting with speculative trading profits. The platform's $15 sign-up bonus and multi-crypto support further lower participation thresholds for XRP holders seeking passive income streams.

Smart Money Shifts XRP to FindMining Amid Regulatory Progress

Institutional investors are moving significant amounts of XRP to FindMining, a cloud computing platform, seeking stable asset appreciation. This trend follows the SEC's recent approval for physical creation and redemption of cryptocurrency ETPs, signaling a favorable regulatory shift that could benefit XRP's pending ETF application.

FindMining reports surging XRP deposits as investors pivot from passive waiting to active yield generation. The platform offers compliant cloud computing services that promise daily passive income and long-term asset growth. "The influx of smart money demonstrates market confidence in our model," said CEO Aydin Ibrahim, whose platform has operated since 2018.

The service requires just 32 XRP to start, with a $15 computing power bonus for new registrants. This low-barrier entry comes as the crypto market shows renewed institutional interest following regulatory developments.

Is XRP a good investment?

Based on technical and fundamental analysis, XRP presents a high-risk, high-reward opportunity. The current price is below the 20-day MA, but oversold conditions and institutional interest (e.g., BlackRock) could drive a rebound. Key factors to monitor include:

| Factor | Impact |

|---|---|

| SEC Lawsuit Resolution | High |

| Institutional Adoption | Medium-Term Bullish |

| MACD Momentum | Short-Term Neutral |

Mia advises waiting for a confirmed breakout above the 20-day MA (3.1912 USDT) or a resolution of the SEC case before increasing exposure.